Introduction

The significant increase in the market concentration of the S&P 500 during the past decade has raised some important questions, including:

How do we construct a sensibly diversified market portfolio when so much of the S&P's volatility is, at times, the result of the idiosyncratic risk of a few large firms?

Does the universe of US stocks - excluding the few large firms that explain much of the rise in the US market's concentration since 2014/15 - offer returns that compensate for a potential multi-year derating of the latter?

Are there segments within the US market that offer attractive real returns which compensate for potentially adverse idiosyncratic shocks to large firms?

This note addresses the third question by considering the size premium and, particularly, its time varying nature. This seemed like a logical place to start looking for excessive risk premia given the superior EPS growth of US small- and mid-cap stocks over the same time period (chart 1).

3 Ideas

I

The size premium was discovered in the early 1980’s by Banz (1). He showed that small stocks have higher average returns than large stocks that are not accounted by market beta. Later this factor was incorporated into standard asset pricing models by Fama and French (3, 4).

Unfortunately the market does not offer us a free lunch. No sooner was the size premium discovered in the US markets than its efficacy waned5. Furthermore, it always had a weak presence in international markets and does not offer a risk-adjusted performance advantage (5, 6).

II

Despite these uncomfortable facts the size premium myth has been analysed in some detail. Of these, the Emery and Koëter paper (2) is one of the more important papers. They show that:

The average annual return of the size premium fell from 10% between 1926 to 1985 to 0.48% between 1985 to 2021, averaging 6.33% over the entire sample.

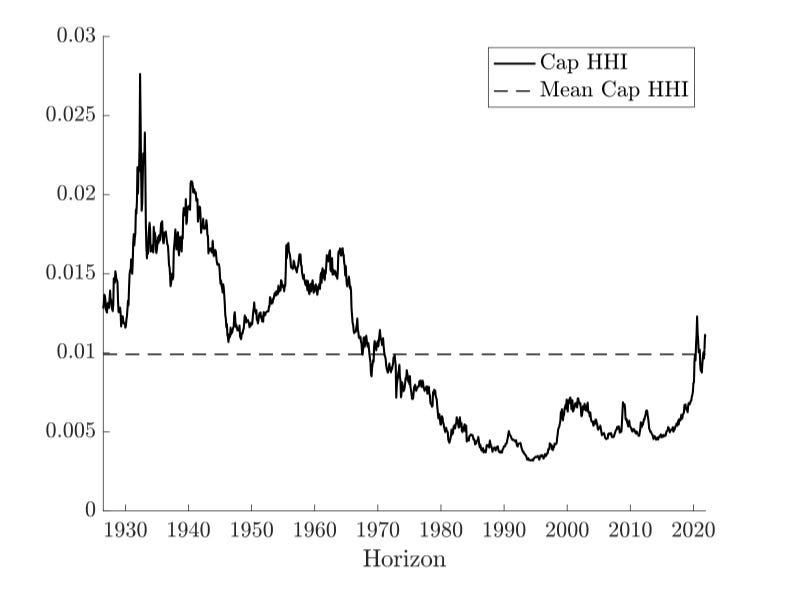

A one standard deviation increase in market concentration increases the size premium by 9.54% p.a., with the effect significant in both sub sample periods.

The results remain significant in the later periods if you replace market concentration with the annual change in stock market concentration.

III

Emery and Koëter (2) show that the increase in size premium associated with increased market concentration (chart2) is entirely accounted for by the derating of high growth firms and firms with high (equity) funding needs. Furthermore, smaller firms have higher sales-growth volatility over the following five years when the stock market is more concentrated.

The reasons for these outcome are a) the increased competition for IPO capital from large cap firms and b) that smaller firms take-on more risky projects to satisfy the market’s higher return requirements.

A Graph or Two

I

II

Conclusion

These effects do not account for the disappearance of the small-cap effect in recent decades.

However, they do account for the time varying nature of the small-cap premium. Unfortunately our ability to gain a tactical edge exploiting the small-cap risk premium is limited by our ability to consistently forecast either the level - or innovation - of market concentration. That is, none.

Finally, these conclusions do not exclude the existence of systematic factors that could, possibly, give investors an edge in the small-cap space.

That’s it - thanks for reading! Please feel free to hit reply - or meet over a coffee - and exchange your thoughts or to just say “hi”.

Johan du Preez

References

Banz, Rolf (1981), “The Relationship between Return and Market Value of Common Stocks.” Journal of Financial Economics, vol. 9 (1), pp. 3-18.

Logan Emery and Joren Koëter (2023), “The Size Premium in a Granular Economy,” SSRN Working Paper.

Fama, Eugene F. and Kenneth R. French (1993), “Common Risk Factors in the Returns on Stocks and Bonds,” The Journal of Financial Economics, vol. 33, pp. 3-56.

Fama, Eugene F., and Kenneth R. French (2014), “A Five-Factor Asset Pricing Model”, Working paper, Booth School of Business, University of Chicago.

Kalesnik, Vitali, and Noah Beck, (2014), “Busting the Myth About Size,” Working Paper Research Affiliates, LLC.

Hsu, Jason and Vitali Kalesnkik (2014), “Finding Smart Beta in the Factor Zoo,” Working Paper Research Affiliates, LLC.